A Quality Review Of PureStream

REPORT SUMMARY

SCOPE

PureStream is unlike a traditional ATS and although evaluating executions against standard benchmarks can be helpful, the unique mechanism of PureStream requires more in-depth and specific analysis. Some of the questions we attempt to answer in this report are:

• How does PureStream work?

• What is the impact of a PureStream print?

• Is there a difference when the source/reference print is on an exchange versus a dark pool (ADF)?

• Are PureStream prints subject to delay?

• Does the sequence of source prints and PureStream prints result in leakage?

• How can a trader use PureStream to add value?

As each trade is two sided (and therefore any price movements would net to zero), we will focus only on buy orders. Results for sell orders are the inverse of the results for buy orders. Trades in PureStream are based on trades executed on other venues. As such, the source trade can be an exchange, an ATS, a principal trade, a single dealer platform, or a retail trade. We will refer to these as “source trades” for the sake of simplicity.

HOW DOES PURESTREAM WORK?

The premise behind PureStream is that buyers and sellers can achieve significantly reduced market impact by “piggybacking” on a reference price established in the broader marketplace via price and quantity reported to the SIP. Instead of demanding a specific point-in-time quantity or breaking up orders into quantity-based fills, PureStream participants specify a percentage rate of the reference trades that they are willing to accept. Once buyers and sellers match, a “stream” is established and fills are allocated at the SIP reference price as they occur in the market. “Liquidity Discovery” rates of up to 500%--or 5 times the reported SIP trade, are available.

If multiple counterparties are present, order prioritization is based on four factors; the highest rate, the largest order size, the marketability of the limit, and then time. Their goal is to prioritize the best liquidity.

A simple example follows for a stream of IMUX on January 3, 2022. Two orders matched, one a liquidity seeking order and one a participation order. They matched on a 15% participation rate.

This means that for each print, there will be an equivalent print from PureStream for 15% of the size of the source print.* Some examples follow. There is a print for 100 shares at 10.62 at 11:08:02.184640805, followed by a print of 15 shares by PureStream at 11:08:02.185359037. This will continue to occur until the order quantities are exhausted or the trade is cancelled.

The first print, 100 shares executed at 10.62, is followed by a PureStream print of 15 shares at the same price. While in this case, the PureStream prints occur right after the source trades, there usually are multiple trades that occur between the source print and the PureStream print, making the relationship much harder to identify.

*If the execution price on the source trade is not marketable with it prints, there will be no equivalent PureStream print.

PureStream IMUX transactions, January 3, 2022

SUMMARY

The mechanism of PureStream is unique, allowing traders to select a participation rate based on a price and shares of trades that occur in the broader market. Although a significant percentage of the fills reference lit trades, our analysis revealed that fills through PureStream users enjoy little to no adverse post-trade cost , which is a significant improvement over the cost that the original source trade incurred. In general, fills completed through PureStream incurred far less post-trade cost than than trading on exchanges and in traditional dark pools. If PureStream is integrated properly, it can provide traders with a significant benefit, especially if counterparties can be found in difficult to trade names.

PRICE

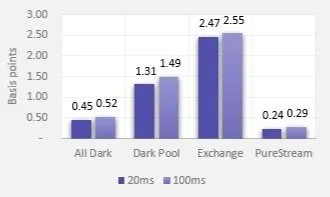

We found that there was minimal price movement after PureStream fills. Classifying the fills by the source and direction of the reference print confirmed that when reference prices for PureStream fills are sourced from lit exchanges, there is more significant post-trade reversion or continuance, depending on the order direction. We noticed, however, that PureStream fills are insulated from post-trade price effects. When comparing post-fill price movement on exchanges and dark pools, PureStream has far less movement than all venues.

Post trade price movement by category after aggressive fills

In order to understand whether any adverse price movement was the result of PureStream fills, we closely examined the sequence of events surrounding the broader market reference source fills and the PureStream prints. Adverse price movement was in large part associated with reference prices sourced from exchanges, and even more so closely associated with aggressive fills (those that crossed the spread.) Post-trade movement began immediately after the fill and continued out to 100 milliseconds. We found that although PureStream fills can reference aggressive lit fills that can incur significant price continuance:

The vast majority of adverse price movement occurred after the reference print but prior to the PureStream print, which indicates that the PureStream fill did not cause the adverse movement.

The PureStream fill had minimal post-trade price movement. We measured post trade movement at 20 ms and 100 ms and the result was consistently was near zero across multple stream rate categories, fill sizes, security types, and direction.

Any price movement that occurred after the source print would have occured regardless of whether or not the PureStream print happened.

LIQUIDITY CAPTURE

We found that although PureStream can accommodate liquidity seeking strategies with stream rates up to 500%, typical counterparties match at rates well below 100%. This is because the prevalence of participation-type strategies. This results in very small fill sizes that have little to no impact. It is important to note that we found no correlation between impact cost and size , regardless of whether we evaluated fills by stream rate or fill size.

There was very little post-trade price movement for all share quantities up until quantities greater than 1,000 shares. We did see some post-trade movement, however it was significantly less than the markouts that we measured from the source print on the corresponding venue.

We reviewed post trade price movement, we found that the 20 millisecond markouts even for stream rates over 100% were very close to zero.

STREAM IMPACT

We attempted to assess the impact of the sequence on broader market price by looking at momentum change over the life of the order. Note that assessing information leakage over time can be a noisy calculation. The longer the duration of the order, the greater the potential that there will be external factors such as news or momentum from other trading activity that will add distortion. The average stream duration was two minutes and we found that for orders of this duration or less, the 20 ms markout was very close to zero. In the 5 to 10 millisecond bucket, we found that 20 ms markout averaged -3.5 bps for streams that lasted five to ten minutes. This means that buyers would experience 3.5 bps of favorable price movement (and the inverse for sellers.)

Price Movement by Stream Rate, Original Order, First to Last Fill

INACCESSIBLE LIQUIDITY

PureStream offers a way for institutional traders to participate in high retail names potentially with reduced impact cost. One of the difficulties that traders currently face is how to trade securities that have a significant share of retail involvement. These are not just Gamestop and AMC, but also Amazon, Ford, and other securities that are widely held by institutional managers. Up to 40% or more of the liquidity in these names are inaccessible because retail brokers send these trades directly to wholesalers for execution. With so much of liquidity traded away from the market, Babelfish estimates that it has become three times as costly for institutions to trade stocks with a high retail share. Dark pools and non, primary alternative exchanges are no longer viable algo destinations for high retail names and can create information leakage when used for only small quantities, forcing buy side traders to seek liquidity on exchanges. This is an inherently costly strategy. Algos also do not account for the inaccessible share, which can also promote information leakage. By adjusting stream rate on PureStream to account for the inaccessible liquidity percentage, traders can compensate with potentially paying the impact cost of trading on an exchange.

PRINT DELAY

Our analysis indicates that the delay between a trade and the associated PureStream trade is usually in the single digit millisecond range. 75% of the trades print within 1.63 milliseconds of the source trade and 90% within 9.18 milliseconds. The majority of the longer delays are due to the ADF prints hitting the tape. When you analyze based on the time ADF trades print to the tape, rather than when they execute, 95% of the PureStream participant timestamps occur within 0.56 milliseconds.

Delay between Source and PureStream Fills